Coal production has for long been seen as a profitable venture. The competitive mining sector mostly dominated by state-owned entities have been on a diversifying prowl as prospects of further expansion seem limited. With the government having a strong intent to include renewable energy as a major fuel source for India’s dynamic economy, these coal firms have shown extraordinary resilience even amidst multiple crises and fiascos. This week, we will take a look at the state of affairs of Indian Coal Mines in 2019-20. The data has been scrapped from a paper titled “A novel dataset for analysing sub-national socioeconomic developments in the Indian coal industry” by Sandeep Pai and Hisham Zerriffi. The exact dataset can be obtained from Harvard Dataverse.

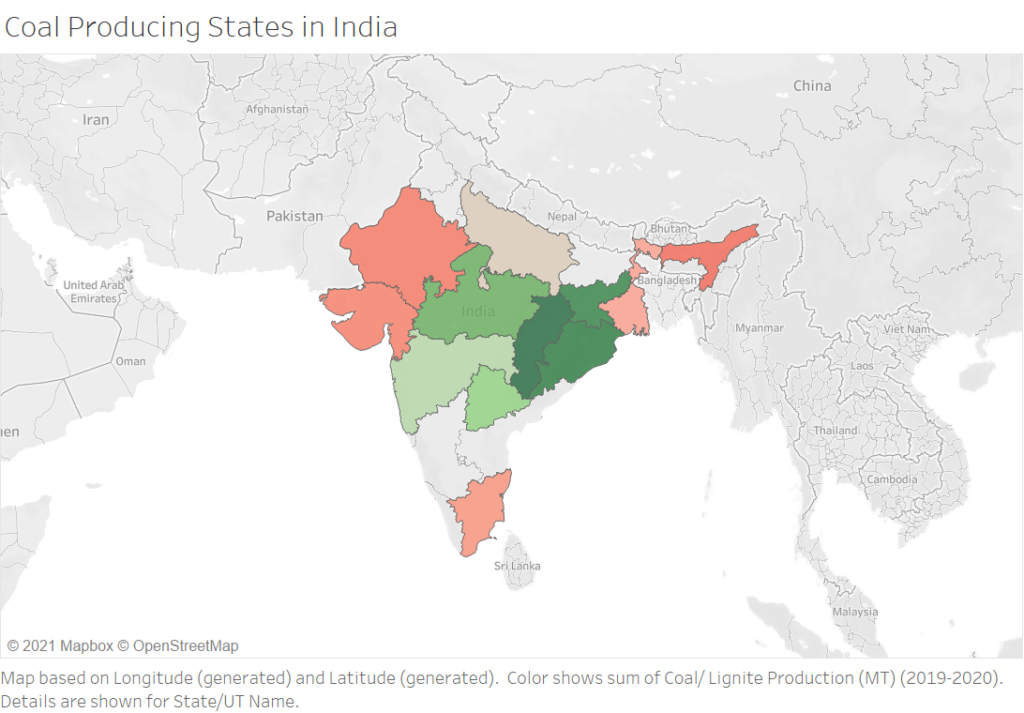

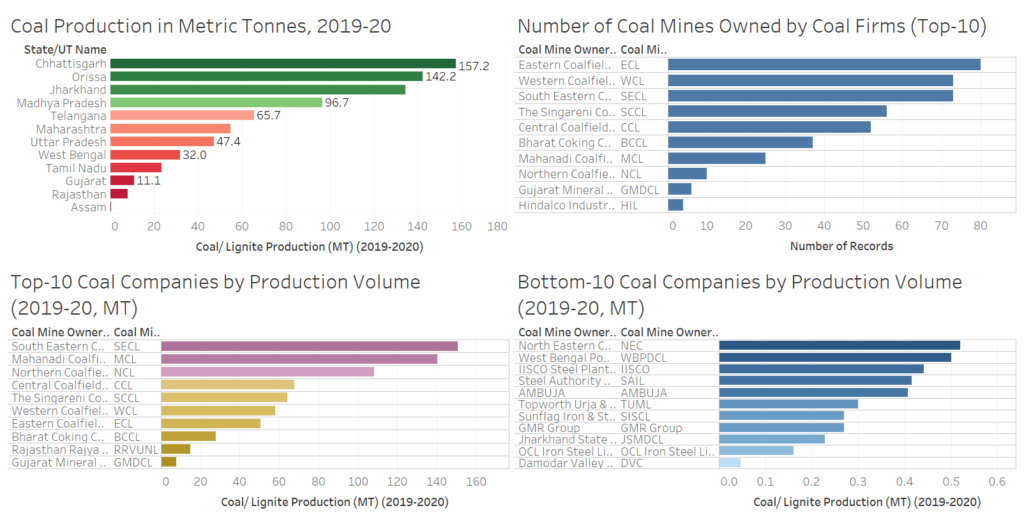

1. Coal-producing States in India:

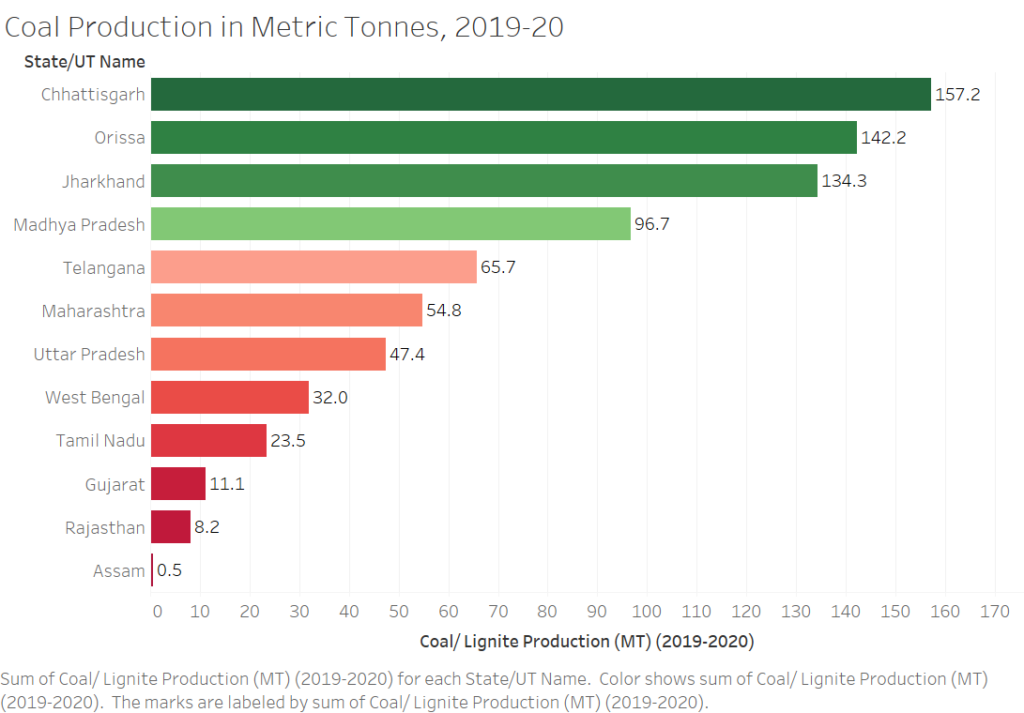

States that have a greenish tinge produce larger amounts of coal/lignite in million tonnes. Notice how the mineral-rich belt of Odisha, Chattisgarh, Jharkhand and Madhya Pradesh greatly outweigh production from other states. Assam produces the least amount of coal, and even West Bengal was found lagging in terms of the overall quantity of coal excavated in 2019-20. In quantitative terms, we have another chart to put down the numbers:

It can be made out quite easily that the triad of Chattisgarh, Orissa and Jharkhand alone constitute 56% of the total production volume, while the rest of the states squabble for the balance production amount. As evident from the geospatial map as well, Assam lags the other members of the coal-producing league by quite some margin.

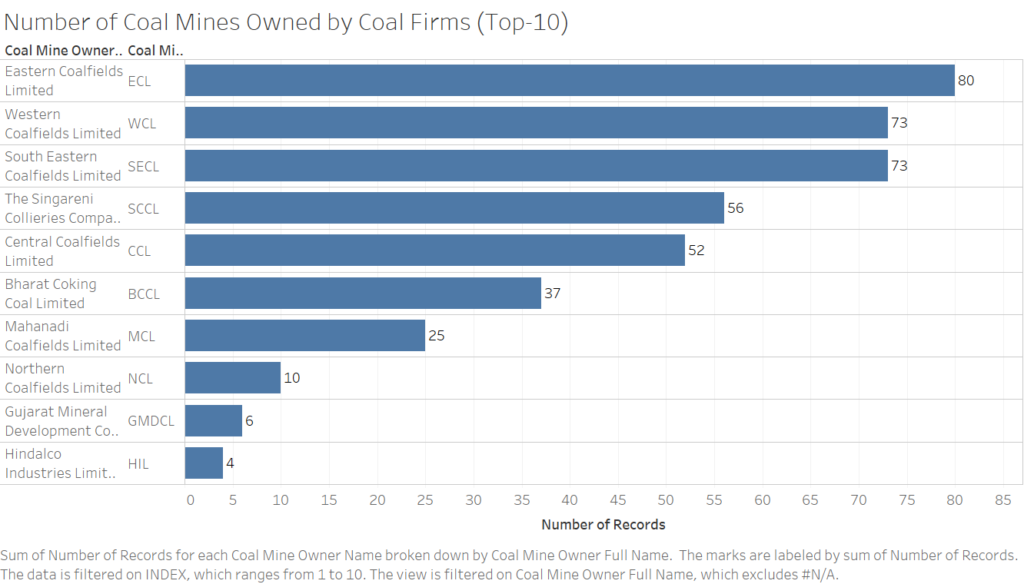

2. Mines owned by Company:

Most of the public sector companies with the highest number of mines under their possessions are subsidiaries of Coal India, a mammoth in terms of its market size and production volume. Only three firms (SCCL, GMDCL, and HIL) in the top ten list for the number of mines owned by the companies are not owned by Coal India.

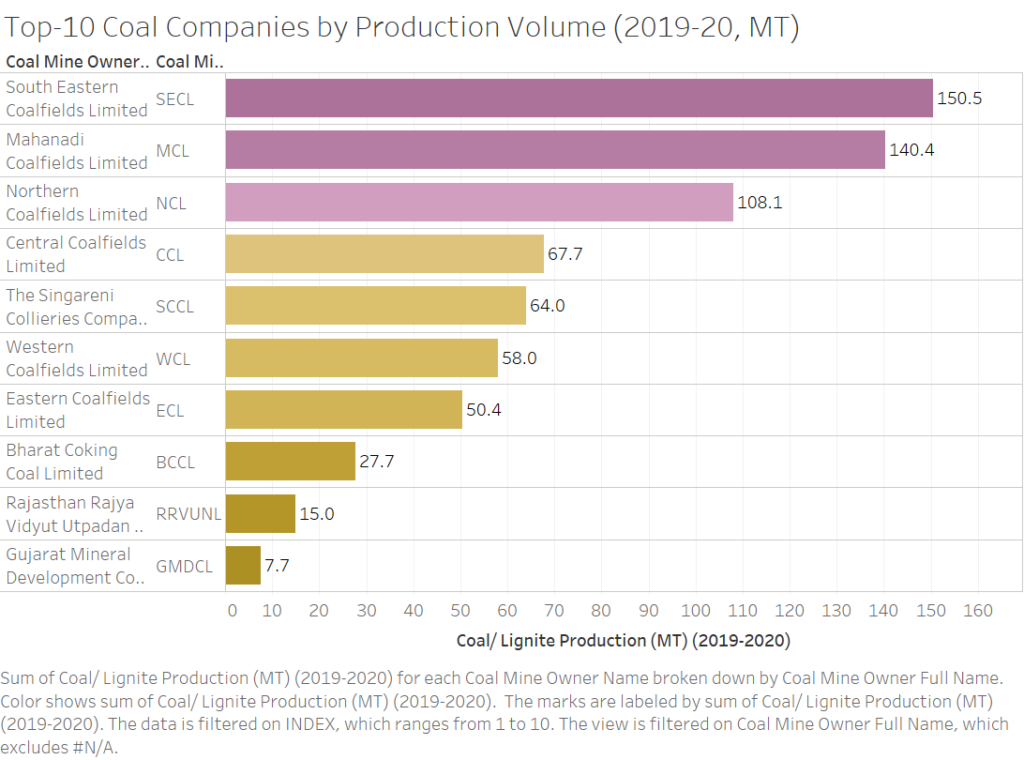

3. Coal Firms by Production Volume (Million Tonnes)

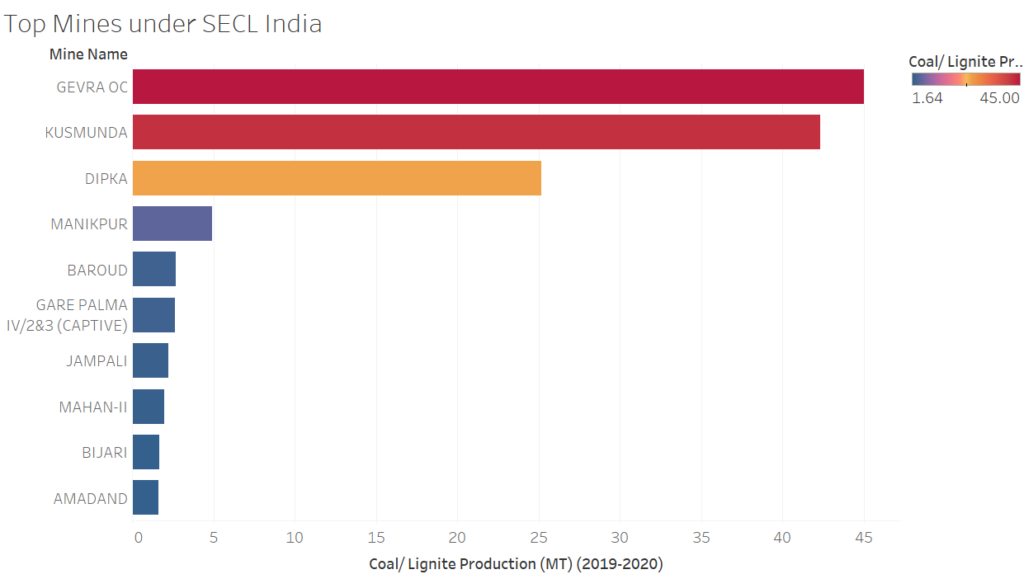

The South Eastern Coalfields lead the way in terms of the production volume, having coal-rich mines under its possession. Gevra OC, the mine with the largest production amount, falls under its jurisdiction. SECL has at present rights over 73 coal mines. The South Eastern Coalfields is closely followed by Mahanadi Coalfields, which operates primarily from Odisha. Below is a detailed break-up of leading coal mines under SECL:

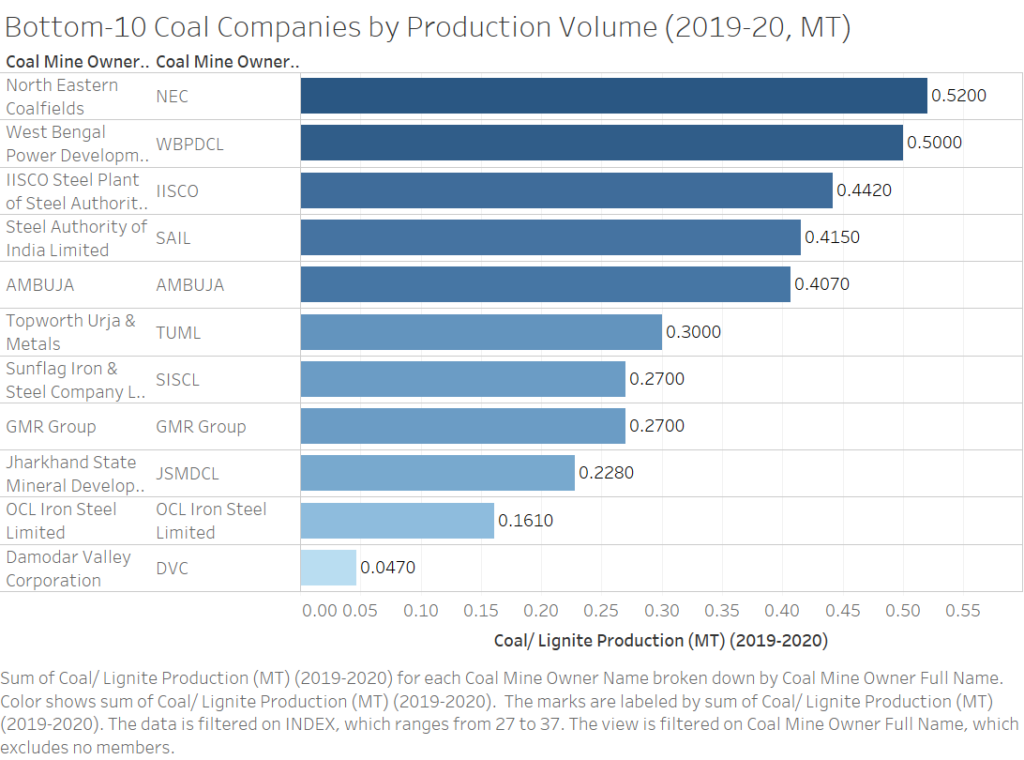

4. Bottom 10 Coal Production Companies by Volume (Million Tonnes):

Most of these lowly-ranked firms are privately owned and has been set up not for explicit commercial purposes, but to serve a subsidiary cause. For example, WBPDCL does not primarily sell coal; it excavates coal to produce power for further distribution to DISCOMs. Take the Ambuja group, which produces coal for the sole purpose of serving its own commercial interest. Thus, they do not have incentives to spend huge amounts on obtaining rich mines. However, the presence of North Eastern Coalfields- a derivative of Coal India Limited- shows that the North East region is not conducive to coal production, as reiterated by the first bar chart which found Assam as the state with the last-ranked among coal producing states.

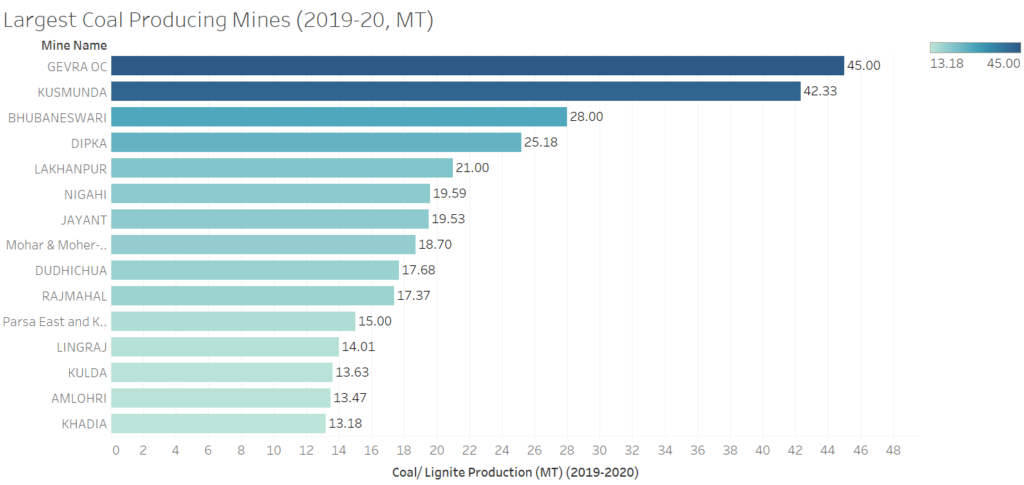

5. Richest Coal Mines across India

India’s largest open-cast mine is the Gevra mine in Chattisgarh. In fact, both Gevra and Kusmunda mines belong to the Korba coalfields in Chattisgarh. Bhubaneswari mine belongs to the Mahanadi Coalfields Limited and is located in Angul, Odisha.

Four of the most important takeaways from the above visualisation exercise have been wrapped up into a single dashboard:

One response to “Data Viz of the Week: Indian Coal Mines Production (2019-2020)”

It was a delight to go through such a detailed overview of this crucial industry.